#BreakTheBias: Empowered Women of Indonesian MSMEs

- MICRA

- Mar 31, 2022

- 4 min read

Updated: Apr 25, 2022

Blog by Anis Nur Aini, MICRA Manager, Research and Technical Assistance

The Covid-19 pandemic has been in our lives for almost three years, and during those times, it had a significant impact on Indonesia's socioeconomic conditions, including the Micro, Small, and Medium Enterprises (MSME) sector.

According to a report from the Central Statistics Agency (BPS, 2020), 69.02% of MSMEs experienced capital difficulties during the Covid-19 pandemic. MSMEs, the largest contributor to Indonesia’s Gross Domestic Product (GDP) with 61.07%, must adapt to changes that occurred after the Covid-19 pandemic hit, including women who contributed to the MSME sector. [1]

March 8 is celebrated as International Women's Day when the whole world commemorates the fight for women's rights. This year, this event carries the theme #BreakTheBias. This was also mentioned by the President of the Republic of Indonesia, Joko Widodo, who referred to women whenever the world was hit by uncertainty, especially during disasters and the Covid-19 pandemic in 2020.

It is undeniable that women have an important role and control in facing various challenges in economic recovery efforts during and after the pandemic, especially in the MSME sector with 64.5% is dominated by women entrepreneurs. This implies the significant role of women in Indonesia's economic growth. In addition, 97% of the workforce in the MSME sector is also dominated by women. [2]

Based on the narrative of the Minister of Finance of the Republic of Indonesia Sri Mulyani Indrawati, women have the knowledge and capacity to think about securing funds for their families and investing them in productive fields. This signifies that women have the potential and significant ability to contribute to Indonesia's economic growth.

The McKinsey Global Institute reports that advancing women's equality will increase global GDP by $12 trillion.[3] The existence of this potential needs to be supported by various efforts to close the gender gap in society. As women are often referred to as the “second class” and do not get the same rights as men, this inequality makes it difficult for them to develop their full potential.

The Challenges

Several studies conducted by MICRA narrowed down the three main challenges faced by women, especially MSME entrepreneurs in Indonesia. These three challenges are:

1. Low index of financial literacy. Financial literacy is the main component in mastering household finances and business management. Based on a financial literacy survey conducted by Otoritas Jasa Keuangan (Financial Services Authority of Indonesia), women have a lower financial literacy index than men. This influences the financial strategies and decisions taken which will directly affect the efforts of women workers and women entrepreneurs in the MSME sector to increase their income and develop their businesses. The figure below shows a significant increase in the financial literacy index for women. In the 2016 survey year, women's financial literacy index was at the level of 25.50% and increased to 36.13% in the 2019 survey.

Financial Literacy Index by Gender

Graph 1. Financial Literacy Index by Gender[4]

2. Limited access and knowledge of digitalization. The Covid-19 pandemic has accelerated changes in all elements of society to adapt more quickly to advances in technology and information. Digitalization helps business growth, however, based on BPS data for 2020, only 3.79 million out of 59.2 million MSMEs including women entrepreneurs have used online platforms to market their businesses. Google Indonesia's Head of Marketing said that 53% of women had difficulty using the internet for information due to their lack of knowledge. Thus, digital access must also be accompanied by digital literacy so that the use of the internet becomes optimal. This will affect women's ability to use technology and information to support their business growth.

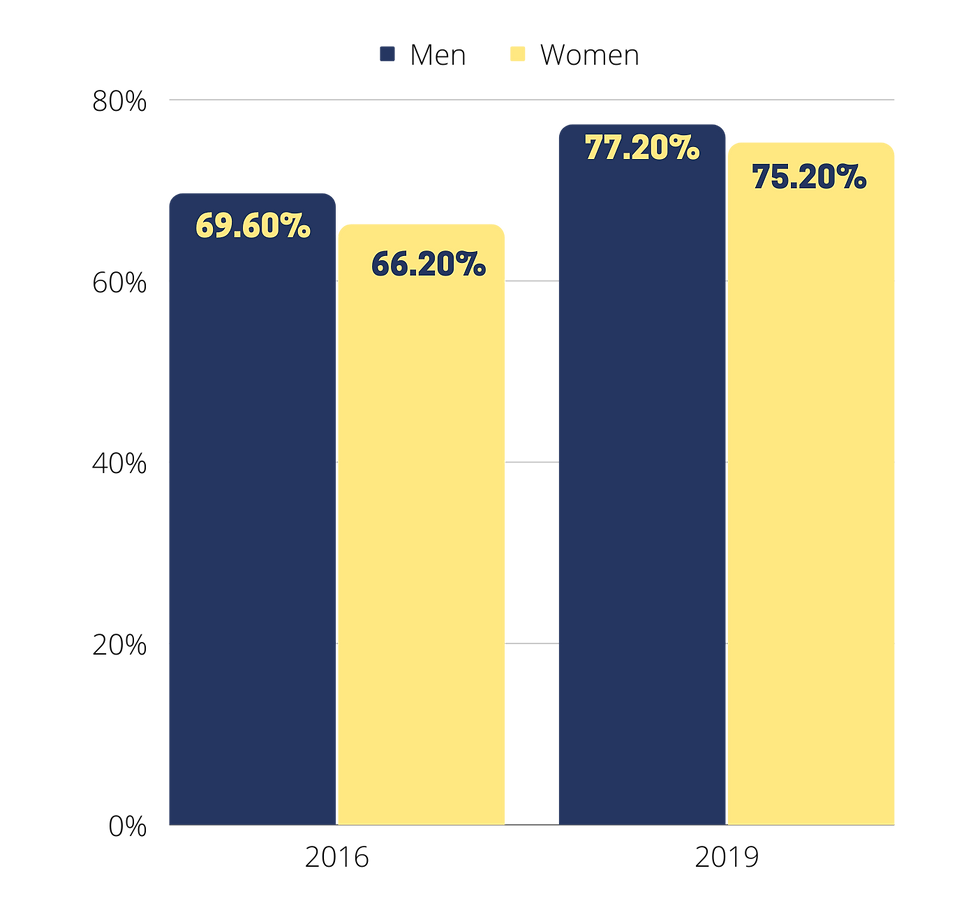

3. Low access to available financial services. The gender gap can also be seen in the low access of women to financial services, including financial institutions. This is illustrated by the significant difference between men and women in the financial inclusion index. Financial inclusion is the availability of access to various financial institutions, products, and services by the needs and abilities of the community to improve welfare. In the chart below, the women's financial inclusion index is at 75.20%, 4% below the men's financial inclusion index which reached 77.20%.[5]

Financial Inclusion Index by Gender

Graph 2. Financial Inclusion Index by Gender

MICRA’s Effort

Responding to the existing challenges, MICRA is trying efficient ways to support gender equality in Indonesia. One of which is through the provision of women's capacity-building programs in collaboration with external parties. Several topics of training that have been carried out by MICRA are increasing women's financial literacy, improving income generation for women entrepreneurs, growth in the entrepreneurial spirit of women farmers, as well as improving communication and negotiation techniques as an effort to increase women's capacity in running a business. The selection of these training topics is based on the conditions and needs of each prospective training participant.

One of the women's capacity-building training programs that are still running is the HERFinance program. Since 2015, MICRA, in collaboration with BSR Hong Kong has provided financial literacy training to factory workers in Indonesia. As of March 2022, MICRA has conducted financial literacy training for 17 factories with a total of 19,015 workers. Some of the topics taught in the training were the following:

Understanding different financial needs and wants

Making a household budget

Getting used to saving

Borrowing money wisely

Proper conversation about finances with family members

Introducing financial products and services to the trainees.

Based on a survey conducted by MICRA, there were significant differences between the training participants before and after attending the training. The results of the training showed that there was a boost in the percentage of saving habits among the training participants with an average increase of 37.5%. This is also supported by the added ownership of financial products in financial institutions, with an average increase of 28% from before training.

The significant impact of providing training to women has increased MICRA's enthusiasm to support #BreakTheBias and gender equality. This supports MICRA’s belief that women are important assets in the country's economy, and, with the proper support right programs, women will be more empowered and be a strong pillar of the community.

Source: [1]https://www.kemenkeu.go.id/publikasi/berita/governmental-terus-perukur-umkm-via-vari-form-bantuan/ [2]https://www.kemenkeu.go.id/publikasi/berita/ini-contribution-perempuan-dalam-ekonomi-nasional/ [3]https://www.mckinsey.com/featured-insights/employment-and-growth/how-advancing-womens-equality-can-add-12-trillion-to-global-growth#:~:text=How%20advancing %20women's%20equality%20can%20add%20%2412%20trillion%20to%20global%20growth,-September%201%2C%202015&text=A%20McKinsey%20Global%20Institute%20report,gaps%20in%20work%20and%20society. [4]https://www.ojk.go.id/id/berita-dan-activities/publikasi/Documents/Pages/Strategi-Nasional-Literasi-Keuangan-Indonesia-2021-2025/STRATEGI%20NASIONAL%20LITERASI%20KEUANGAN%20INDONESIA% 20%28SNLKI%29%202021%20-%202025.pdf [5]https://www.ojk.go.id/id/berita-dan-activities/publikasi/Documents/Pages/Strategi-Nasional-Literasi-Keuangan-Indonesia-2021-2025/STRATEGI%20NASIONAL%20LITERASI%20KEUANGAN%20INDONESIA% 20%28SNLKI%29%202021%20-%202025.pdf

Comments